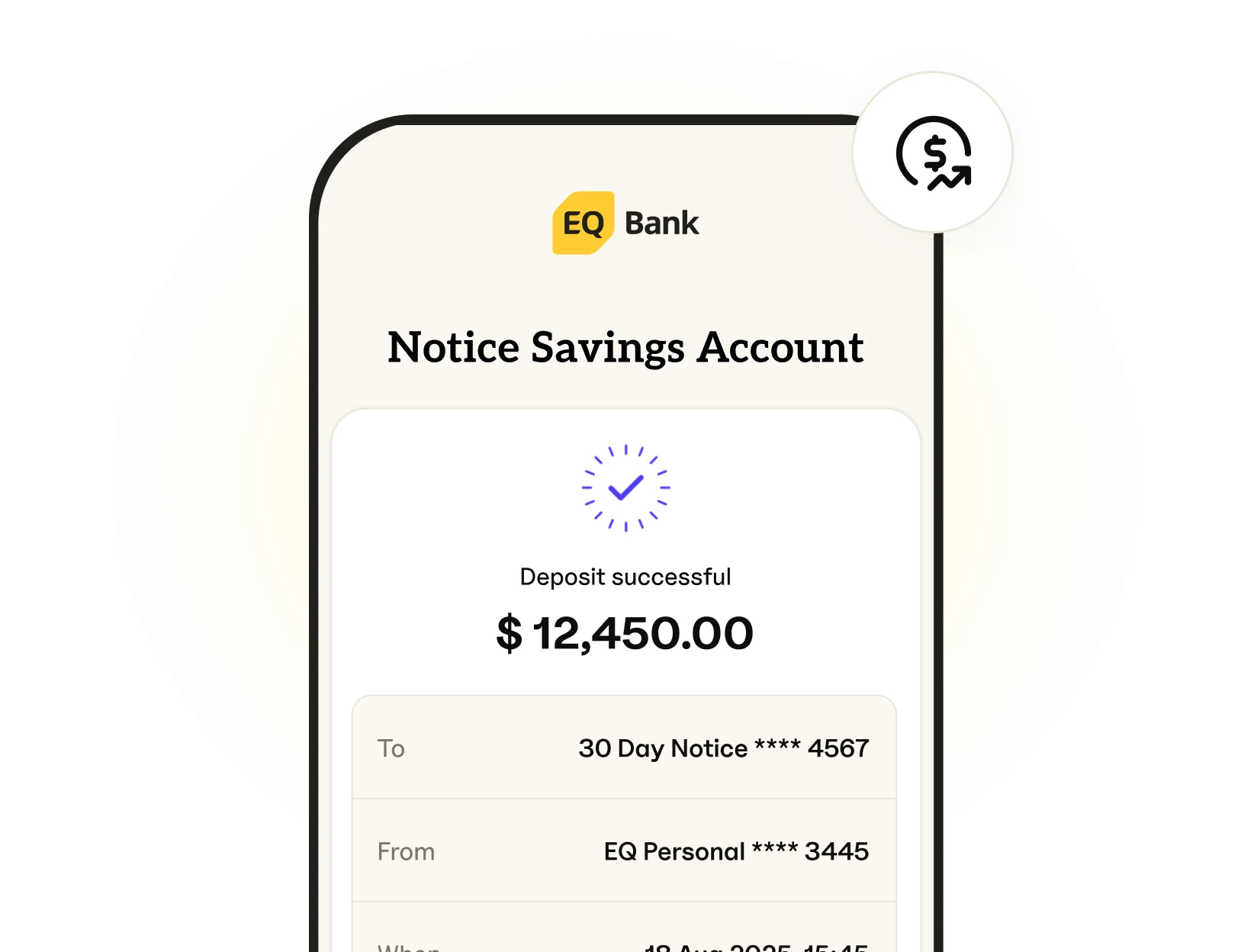

Notice Savings Account

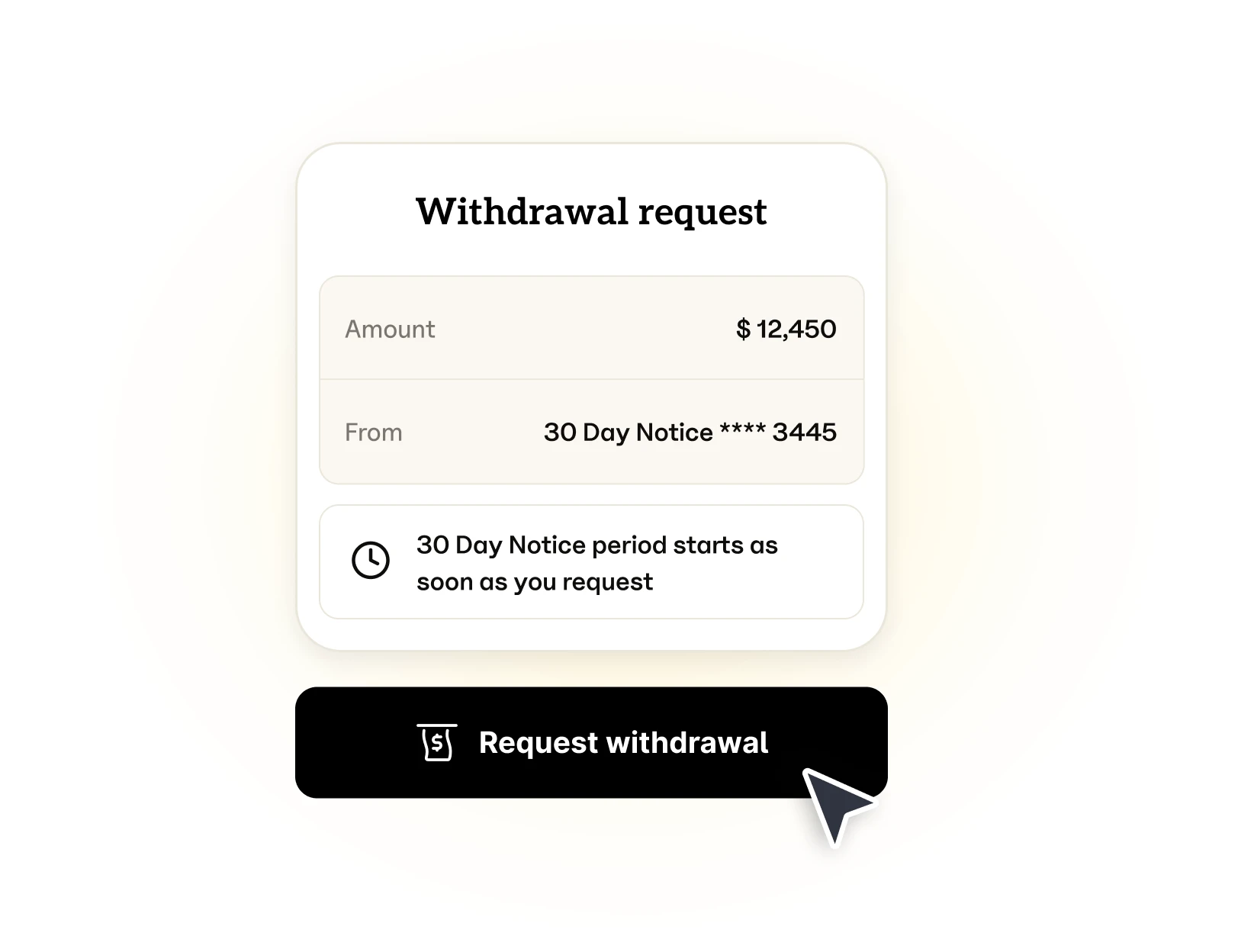

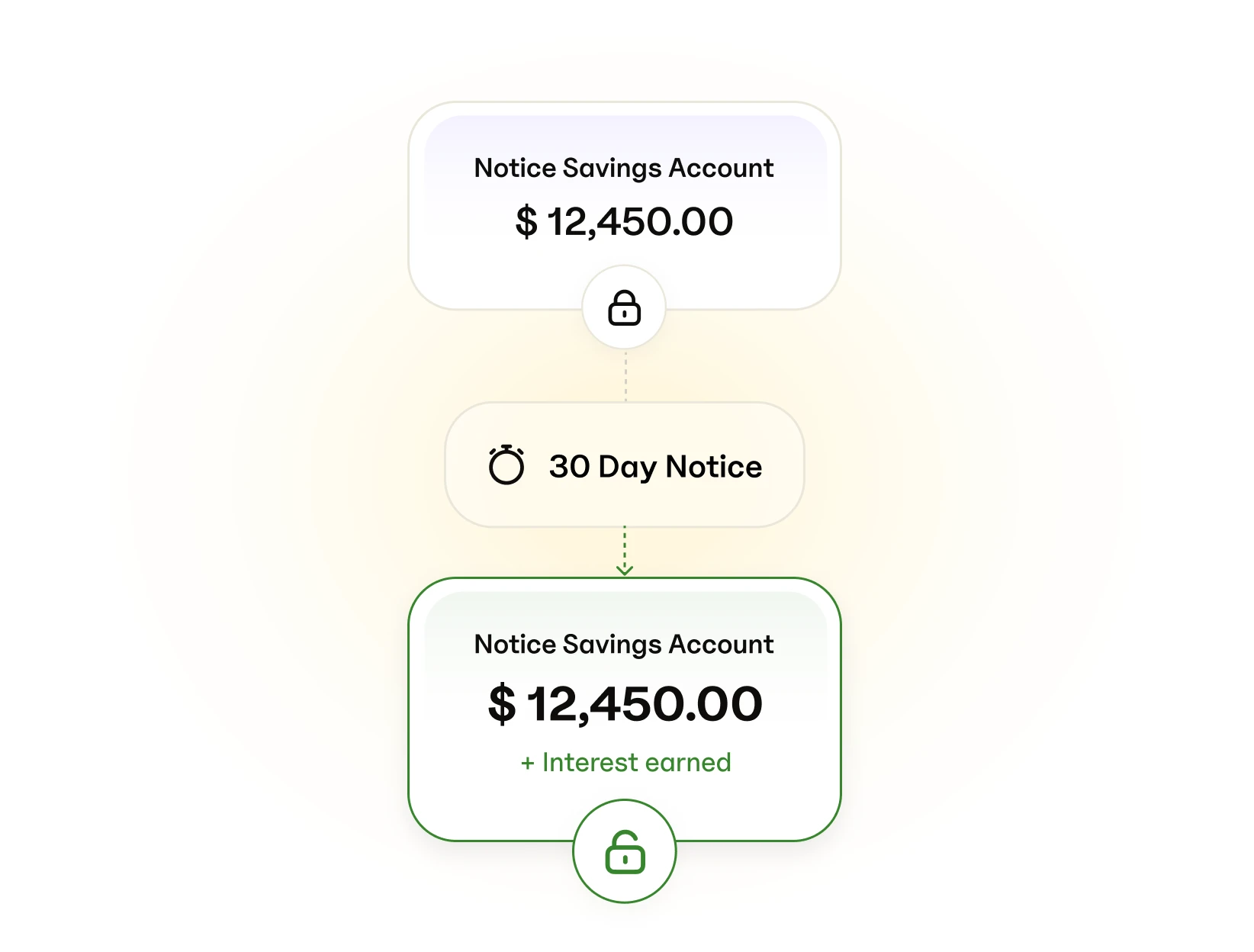

Give advance notice on withdrawals, get a better rate.

Earn up to 2.75% interest(Footnote *)

No fees, no minimum balance

CDIC eligibility† for deposits

10 Day Notice Savings Account

Open an account30 Day Notice Savings Account

Open an accountHow our Notice Savings Account Works

2.35%*

2.75%*

Is our Notice Savings Account right for you?

It’s right for you if:

- You want to save longer to receive higher interest.

- You’re able to wait the 10- or 30-day notice period to access your funds.

- You want free unlimited deposits and withdrawals.

- You’re looking for an account that’s eligible for CDIC protection.

- You're looking for a completely digital banking experience.

It’s not right for you if:

- You’re looking to make everyday banking transactions, such as direct deposits, Interac e-Transfers®, and bill payments.

- You need instant access to your funds.

Visit our FAQ for more details about our Notice Savings Account.